What are impact investments?

The financial sector has already notched up many successes where social awareness has proved profitable.

It was only a few years ago that, in the name of profit, big companies were fighting a running battle with environmental and social concerns like equality. Then they went on to incorporate sustainability as a horizontal pillar of their activities. But impact investments, an increasingly popular financial concept, take this development a step further in associating economic return with social benefit. Let’s have a look at this new phenomenon.

What are impact investments?

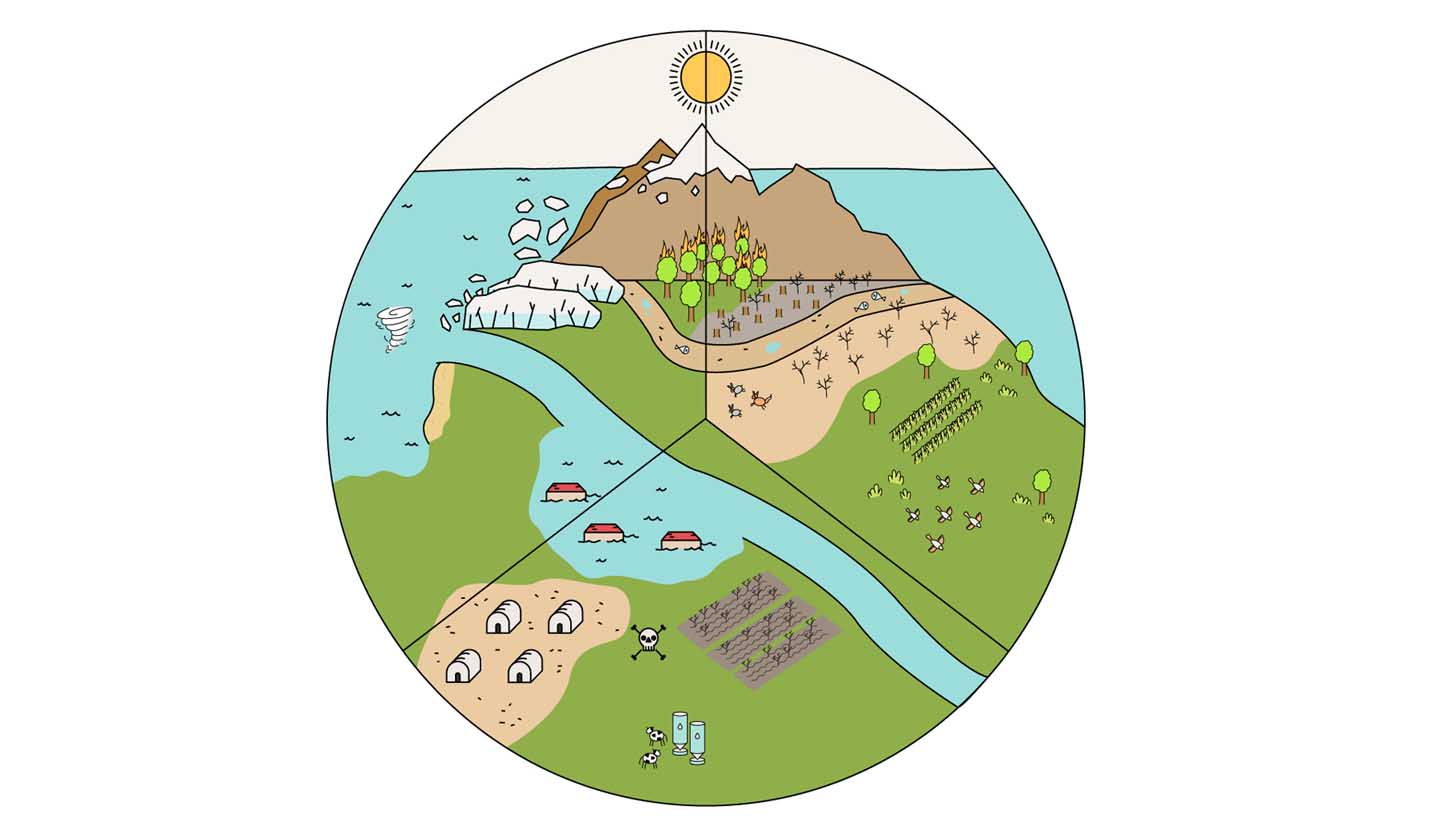

Impact or social impact investments mainly aim, right from the outset, to benefit society and/or the environment. They are not philanthropic in nature, nor are they direct grants, rather investments that seek a capital return at least the same as that invested, but which intend to produce a positive impact on the planet in a quantifiable and measurable way. Or, to put It bluntly: no impact, no investment.

The United Nations Global Compact defines impact investments as the allocation of capital to social enterprises and other structures with the intention of creating social and environmental benefits beyond merely financial return.

“Intention” being the boundary

In recent years, innovative entrepreneurial tools like these have become common to solve social and environmental problems affecting us. Another financing model that prioritizes social impact is socially responsible investment (SRI), a type of investment that, from the long-term perspective, brings together environmental, social and governance criteria to the process of studying and selecting of an investment portfolio.

Impact investment goes a step further and ensures that the positive social or investment impact of a project is quantifiable and communicated transparently. The main difference between conventional and impact investment focuses on intentionality, since impact investments mainly seek to generate social value; the financial benefit is complementary.

A financial instrument on the rise

In the 1960s, Martin Luther King Jr. performed an essential role in raising awareness about the civil rights movement by criticizing companies that opposed the cause as socially irresponsible.

As awareness has grown in recent years about global warming and climate change, socially responsible investment has led to companies impacting positively on the environment by reducing emissions or investing in sources of clean, sustainable energy.

The data gathered by the European Commission on this issue is very interesting: currently one in four companies established in the European Union is a social enterprise, and this ratio rises to one in three in Finland, France and Belgium. In the case of social impact investments, the Global Steering Group (GSG) estimates that this kind of investment will double worldwide in the next few years and reach 400 billion euros in 2020, although it will continue to be less than SRI.

To convince financial actors that they should make a greater commitment to the planet, the European Social Investment Forum (EUROSIF) was set up in 2009, an association made up of pension funds, financial operators, academic and research centers, and NGOs, seeking to increase investment in projects according to central criteria of sustainability, the respect for the environment and social benefit.

Crowdinvesting and other successes

The financial sector has already notched up many successes where social awareness has proved profitable. The specialized fund Ship2B, for example, has various social impact projects among its assets, including a forest management startup, a donations-in-kind platform, a new mathematics learning methodology, and a gourmet milk products company whose aim is labor insertion.

Crowdfunding has led to a similarly attractive initiative called crowdinvesting, which allows small investors, through collective financing platforms, to access markets that were previously reserved for big funds.

Bolsa Social was the first platform of this kind to apply for authorization from the Spanish Stock Market Commission (CNMV). A social enterprise, it operates like any crowdfunding platform, allowing investors, concerned about getting a return on their money and the social and environmental impact of their funds, to register freely with the website to access impact projects in which to invest.

Government institutions are also becoming an important driver of social investments. Madrid City Hall this year launched a 30-million-euro public tender for investing in social or environmental impact initiatives.

Sources: madrid.es, Naciones Unidas, Expansión, Diario Responsable