The Green Recovery is the way out of the economic and climate crisis

The measures we take in response to the COVID-19 pandemic will shape the present and future of our planet. A Green Recovery is needed if we are to overcome the current economic and climate crisis.

During the months of lockdown imposed to fight the COVID-19 pandemic, it looked as though the world had stopped. City streets and parks were deserted, there were barely any cars on the roads and many companies had to put their activities on hold for a time. Lockdown allowed us to unprecedented images of cities free from pollution, such as Venice and Bangkok.

The pandemic was the stop sign that slowed the frenetic pace of production and movement to which the world had become accustomed. However, climate change continued to advance, proving itself to be persistent and dangerous. It must be appreciated that combating climate change and navigating the post-COVID crisis will require a common roadmap and a Green Recovery.

Discover how to tackle the economic and climate crisis in this video

You may not be able to watch the video on this page, please click here to watch it on Youtube.

According to the United in Science report, greenhouse gas concentrations in the atmosphere are at record levels, and rose above 410 parts per million during the first half of 2020. Following a temporary decline caused by the lockdown and economic slowdown, with falls of up to 17 % compared to 2019, emissions are heading in the direction of pre-pandemic levels. The World Meteorological Organization estimates that the reduction by the end of the year will be under 7 %.

In addition to there being a sense of a missed opportunity to speed up climate change mitigation, we are heading towards the end of 2020 in a state of panic concerning a second wave of infection and the impact of restrictions on economic activity. There are, therefore, three crises to manage, and there are many voices calling for a reconstruction of the economy that reconciles our health with that of the planet.

We are talking about what has come to be known as the Green Recovery. Governments will invest more than USD 10 trillion to revive their economies over the coming years. If spent well, these massive stimulus packages, which amount to between 10 and 30 % of the GDP of several G20 economies, represent a unique opportunity to achieve a fair and resilient economic recovery that prevents uncontrolled climate change and the collapse of ecosystems.

What is the Green Recovery?

Before we go on, let's see what the Green Recovery is all about. The journey started on 11 December 2019. That was the day that Ursula von der Leyen, President of the European Commission, presented the Green Deal, also known as the EU Green Deal, the roadmap for making the European Union's economy sustainable.

Before we go on, let's see what the Green Recovery is all about. The journey started on 11 December 2019. That was the day that Ursula von der Leyen, President of the European Commission, presented the Green Deal, also known as the EU Green Deal, the roadmap for making the European Union's economy sustainable.

After the first few months of 2020, during which the response to the pandemic saw health and economic issues prioritised, a European movement pushed for a commitment to promote a sustainability-focused recovery. As stated in the manifesto of that initiative, it advocates the mobilisation of green investment packages to "prepare our economies for tomorrow's world". In terms of sustainable development, we know that renewable energies will power the world after the pandemic.

This is an ambitious plan to combat climate change with 50 specific action measures and a lofty end goal: for Europe to achieve carbon neutrality by 2050, separating economic growth from the use of the planet's resources and reducing emissions by at least 55 % over the next 10 years (the target previously set was 40 %). To achieve this, on 4 March 2020, a European Climate Law was proposed that would help turn political agreement into a legal obligation and a trigger for investment.

A global commitment

The Green Recovery has now moved beyond European borders. The United Nations (UN) has launched a powerful campaign, which includes the initiative started by UN Secretary-General António Guterres, calling economic stimulus programmes to be aligned with climate targets and Sustainable Development Goals (SDGs). The International Monetary Fund (IMF) has pledged fiscal, monetary and financial stability measures to facilitate a rapid return to strong, sustainable, balanced and inclusive growth through a Green Recovery.

Some countries, such as Indonesia, are already integrating low-carbon growth into their economic development plans for 2020-2024. Chile recently presented its revised Nationally Determined Contribution, outlining social and economic benefits that will improve livelihoods after the pandemic. Recent parliamentary elections in South Korea have strengthened the country's Green New Deal agenda, and the government has made a commitment to achieve zero net emissions by 2050.

The Green Recovery is the path to the new normal

If one thing is becoming clear, it is that things will not return to normal. Or at least not to the normal that we were used to before the COVID-19 pandemic. It is time to invest in resilient, low-carbon growth. According to Angel Gurría, Secretary-General of the OECD, stimulus packages need to be aligned with ambitious policies to tackle climate change, environmental damage and social inequalities. The path to this new normal after the pandemic must encompass the Green Recovery and a clear commitment to sustainable development.

The role of renewable energies in the Green Recovery

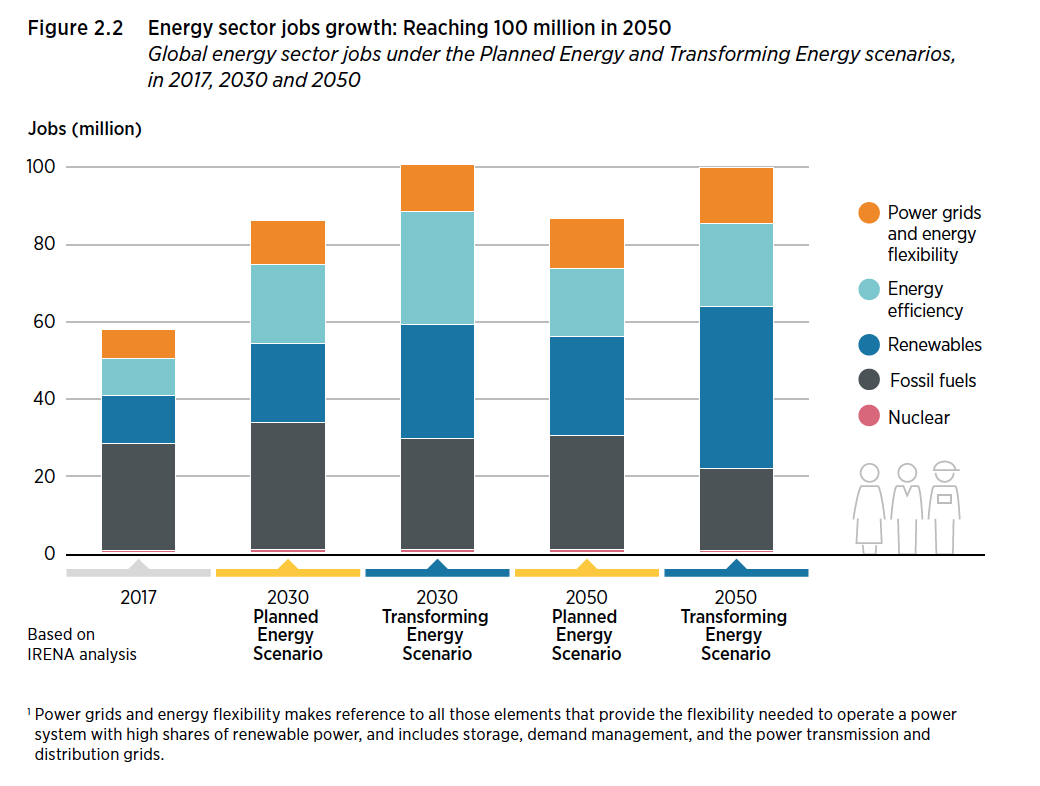

The conclusions reached by studies such as that published by the International Renewable Energy Agency, are clear. The green recovery can simultaneously achieve economic and climate targets and will raise employment levels. According to the report, investing in renewable energy would generate global GDP gains of USD 98 trillion, quadrupling the number of jobs in the sector to 42 million over the next 30 years, and it would significantly improve overall health and welfare indicators. Not to mention that it would reduce the energy industry's carbon dioxide emissions by 70 % by 2050 by replacing fossil fuels.

Building the Green Recovery

Investment in sustainable infrastructure is also an important opportunity for the Green Recovery, given that 60 % of the urban infrastructure that will exist in 2030 has not yet been built. The OECD estimates that, up to then, approximately USD 6.3 trillion of investment will be required annually in energy, transport, water and telecommunications infrastructure in order to sustain growth and enhance the welfare of citizens.

This investment must look beyond the physical characteristics of the infrastructure, known as the built environment, to see how it complements the natural and social environment. Not only does infrastructure improve what nature provides, it also offers a myriad social benefits in the areas of education, employment, health, housing, culture, tourism and leisure. A study by the University of Oxford reveals that every million dollars invested in energy efficiency creates 7.72 full-time jobs, compared to 2.65 jobs created by investment in fossil fuels.

If that investment were 10 % greater, new infrastructure could be built in line with the climate criteria needed in order to, among other things, limit the rise in temperatures to 1.5°C, as recommended by the IPCC. This data and evidence can inform the way we look at investment in building or urban mobility moving forward.

Invest in the Green Recovery to overcome the crisis

Environmental taxation will play a very important role in the Green Recovery, as it raises funds for green investments and at the same time disincentives harmful activities. The tax system should actively support green sectors while polluters should have to bear the cost of environmental harm.

Environmental taxation will play a very important role in the Green Recovery, as it raises funds for green investments and at the same time disincentives harmful activities. The tax system should actively support green sectors while polluters should have to bear the cost of environmental harm.

Another requirement for achieving a Green Recovery is tomobilise private investment in projects that support a decarbonised, sustainable and resilient economy. To do this, governments can provide more precise and coherent definitions of what investments are green, and encourage the financial sector to move capital toward investments that truly meet the needs of the sustainable agenda.

The EU taxonomy for sustainable finance is an important step in this direction. This tool will help different financial agents (fund and asset managers, institutional investors, insurance companies, development and private capital banks, and rating agencies, among others) to identify the risks as well as the opportunities relating to sustainable investment.

The aim of this new taxonomy is to increase confidence in green investments and ensure that they meet sound and transparent criteria aligned with the European Green Deal and the commitments under the Paris Agreement and the UN Sustainable Development Goals. With the introduction of the taxonomy, any investor investing in companies and assets that are declared green will be able to know the extent to which they are actually green.

What we do now will not only reshape our economies and societies, but will also establish what the future of humanity will look like on this planet. Overcoming one crisis does not have to be a prelude to entering another. The Green Recovery is an opportunity to mitigate the effects of climate change and build a new and more sustainable normal.

Sources: OECD, IRENA, UN, United Science, European Commission, IMF, WB, McKinsey